Avoiding Common Accounting Mistakes

Mistakes happen, and sometimes they’re hard to avoid. However, many common accounting mistakes are easily avoidable. We wanted to share some of these with you and give you some tips on how to avoid them.

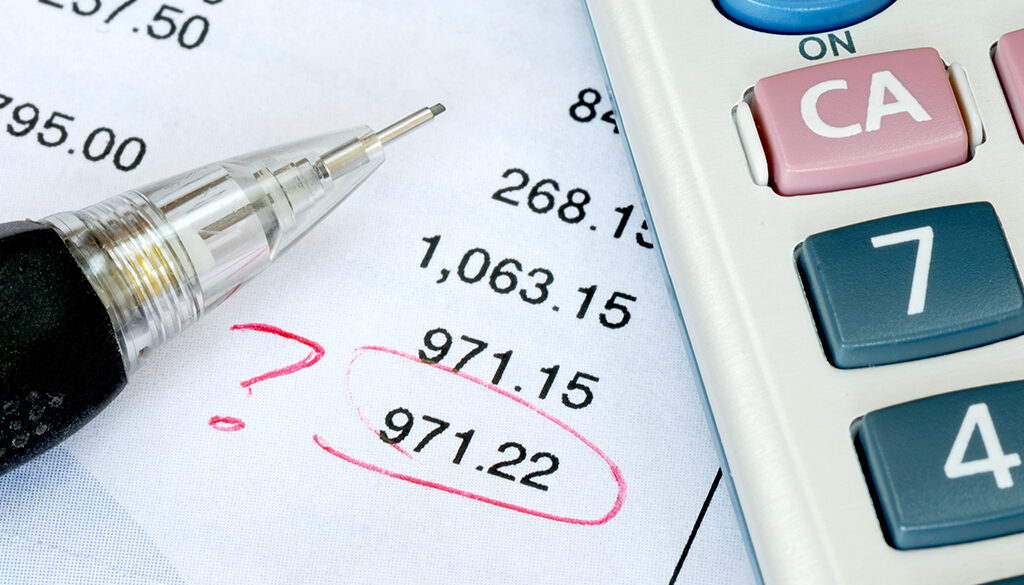

Data Entry Errors

One of the most common accounting errors in any business is related to data entry, and yet, these errors may be the easiest to avoid. One bad data entry error can cost you money, but implementing practices that ensure entries are correct can save you. Avoiding these errors is simple:

- Don’t overload your team. Data entry errors are often borne of fatigue, so don’t give your data entry folks too much to do all at once. Space it out, and set realistic goals.

- Review entries. A second (or third) pair of eyes is better than one. Once a data set has been entered completely, at least one other person should review it for errors and fix any they find.

- Train, train, train your team. Make sure the person (or ideally, people) responsible for data entry are well-trained in your accounting practices. As your business grows and changes, continue to update their training with any new or changed practices.

Procrastination is not your friend

Timing, like many things in life, is extremely important when it comes to managing your business finances. Not only do you have to keep track of tax deadlines, but staying on top of payroll and other frequent expenses is crucial to running an efficient business. Leaving it all to the last minute is a bad idea.

Instead, set aside time each week to reconcile business accounts, review your monthly and annual budgets, and adjust them accordingly. By doing so, you may catch inconsistencies early, at a time when they’re easily fixed. This practice will also allow you to keep track of customer payments, such as if the payment bounces or fails to post.

Seek help when needed

As small business owners ourselves, we understand how overwhelming it can be, trying to grow your business while also trying not to spend or lose too much. You don’t have to do it all by yourself. Perhaps you enjoy managing payroll for your business, but you need help reconciling credit cards and travel expenses. Seek help when and where you need it; be strategic in your hiring. Waiting too long will throw your business off balance, and it may just cost you.

As always, feel free to give SDA a call today to learn how we can help you!

-Stanley & Kelly